The Get Back on Track Tax Method

Still Owe? Haven’t Filed? You’re Not Alone—But You Can Get Back on Track.

Sound Familiar?

If you’re a 1099 earners, solo business owners, real-estate pros, or anyone behind on taxes / needing structure this is best for you!

Let me guess:

You haven’t filed in one (or more) years

You owed way more than expected last year

You make good money, but tax season still feels overwhelming

You’re unsure what applies to you, and what doesn’t

You’re done putting this off another year

GBOTM helps you get organized, compliant, and confident moving forward.

And you’re in the right place to start.

Introducing:

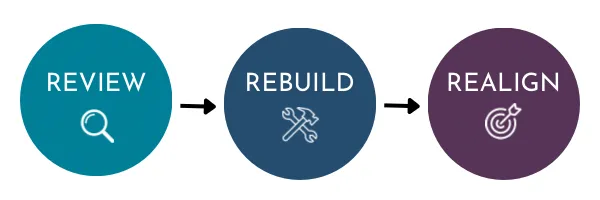

The Get Back on Track Tax Method

This isn’t just about filing returns.

It’s a proven process that helps you get organized, get compliant, and understand what comes next for your taxes.

We help self-employed professionals get caught up, get organized, and feel confident about where they stand with their taxes.

A clear, step-by-step approach to getting back on track with your taxes.

Foundation

For getting this year handled correctly

What this level supports:

Accurate, professional preparation of your current-year tax return

Clear understanding of where you stand

Peace of mind knowing everything is filed correctly

Best for:

Individuals and business owners who want their current-year taxes handled properly and without stress.

Catch-Up

For getting compliant and moving forward

What this level supports:

Filing one or more unfiled tax years

Cleaning up past issues or inconsistencies

Regaining confidence and control over your tax situation

Best for:

Self-employed professionals and business owners who are behind on taxes or need multiple years filed.

Strategic Review

For clarity before moving into optimization

What this level supports:

A professional review of your overall tax picture

Identification of gaps, risks, or missed opportunities

Clear guidance on next steps, including whether entity optimization makes sense

Best for:

Established business owners earning well who want clarity before committing to advanced tax strategy.

Pricing and recommendations are based on your situation, filing years, and complexity.

We’ll walk through the right option during your Tax Savings Call.

Got questions? I got you.

What if I haven’t filed in years?

That’s exactly what GBOTM was created for. We’ll start with a review of where you are, then determine the best path to get you caught up and compliant.

Do I have to be a business owner or real estate professional?

No. While we specialize in working with self-employed professionals and business owners, individuals are also a good fit if they need to get back on track.

Can you prepare my current-year tax return through GBOTM?

Yes. GBOTM includes current-year tax preparation as well as catch-up filing, depending on your situation. The Tax Savings Call helps determine the right level of support.

Is GBOTM just for people who are behind on their taxes?

No. GBOTM is designed for anyone who wants their taxes handled correctly—whether you need to file this year, catch up on past years, or get clarity before moving into tax strategy.

Does GBOTM include tax strategy or entity setup?

GBOTM focuses on getting you compliant, organized, and clear. If it makes sense to move into tax strategy or entity optimization, that will be discussed separately after your foundation is in place.

Can I still join if I already filed this year?

Yes. GBOTM isn’t only for catch-up filing. If you’ve filed but still feel unsure, overwhelmed, or want clarity on what comes next, the Tax Savings Call helps determine the right level of support.

What happens during the Tax Savings Call?

We’ll review your current situation, identify where you are in the process, and determine which GBOTM level makes the most sense for you. There’s no pressure, just clarity on next steps.

Still have questions? The best next step is a Tax Savings Call so we can review your situation together.

TESTIMONIALS

Real Clients. Real Comebacks. With

"Clients Who Were Behind, Worried, or Overwhelmed — And Now Compliant."

"After working with Takara, I have a better understanding of my tax situation, and she helped me put a strategy in place that reduced my tax bill by over $4,000 compared to last year when I first came to her to file my taxes.”

- Jessica

"

Takara is sharp. She saved me ALOT of money this year."

- Jeff

"I had the pleasure of working with Takara Broussard for my taxes (personal and business), and I couldn't be more impressed! From start to finish, her service was top-notch... Her professionalism and knowledge truly set her apart, ensuring that everything was handled accurately and thoroughly."

- Brandi

Let’s Get You Back on Track.

You don’t have to stay overwhelmed, behind, or in the dark about your taxes.

The Get Back on Track Method was designed to clean up the chaos and give you the clarity you’ve been missing.